Types of homes classified as standard homes include single-family homes, apartments, townhouses, and condos. Recreational vehicles (RVs) are alternative living options to typical homes.

RV industry professionals attribute the growth in RV sales to millennials’ and young families’ increased interest in these vehicles and the RVing lifestyle. RVing is a growing, popular activity, with an estimated 40 million Americans embarking on RV trips each year. People who have an interest in buying an RV are sure to pick a vehicle of their choice that suits their needs and preferences, considering there are approximately 7,000 RV dealerships in the United States.

RV living may not be for everyone, so people should weigh the pros and cons of dwelling in an RV and compare them to the advantages and disadvantages of living in a standard home.

Ownership Costs

In general, buying an RV to live in may be less expensive compared to dwelling in typical residences. A crucial advantage to living in an RV that could be a deciding factor in someone’s purchase of one is that RV owners don’t have as many financial obligations as homeowners.

People who live in an apartment are responsible for paying rent, just as residents of single-family must make mortgage payments. The costs of homeownership vary from home to home and location to location. Someone who is choosing their first home or buying a second or third home can benefit from knowing the value of home loans.

Visiting a financially informative site such as Savings.com.au allows Australian Internet users and interested home seekers to compare home loan rates from different lenders. Using this site, people can compare home loan interest rates from the four biggest banks in Australia: ANZ, NAB, Westpac, and Commonwealth Bank. Users can also compare customer-owned interest rates and non-bank loan interest rates.

Savings.com.au’s web pages are resources that can improve users’ and homeowners’ financial literacy by informing them about fixed-rate mortgages and variable-rate mortgages and how to refinance their mortgage by switching from their present mortgage to a new one with lower interest rates.

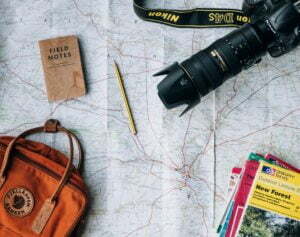

Freedom

RV living allows people to be flexible in where they choose to live and the places they visit. Trips to national parks, mountain ranges, lakefronts, beaches, and more can be possible at any time as RV dwellers drive across the country as they please. Exploring different locations can be an enriching experience that makes RV living advantageous. A potential downside to this is that constantly being on the go can be tiring for some people and uses a lot of gas, which can be expensive.

Repairs

Just as household appliances require maintenance and upgrades, RVs do as well. Continuous use of an RV makes it more prone to damage as it has to endure heat, rain, and extreme weather conditions. RV owners should inspect their vehicles, examine the roofs, and fix and prevent mold, leaks, and anything else that needs repairing. RVers should handle interior repairs as well. Repair costs can range from inexpensive to expensive, so RVers should consider getting RV insurance and an extended warranty plan.

The price of an RV extended warranty can depend on several factors, such as the kind of RV someone owns and the model and year of it. How much RVs cost can influence the price of coverage. Owners that use their RVs full-time tend to incur an additional charge compared to those who use their RVs for commercial reasons.

Where people buy their extended warranties can make a difference in costs as well. America’s RV Warranty offers extended warranties that protect unexpected repair costs. This provider understands that extended warranties cover breakdowns and failures, while insurance covers RV damage and accidents.

Having a warranty and coverage allows people to make the most of their RVs and securely adjust to free living.